In payments, downtime isn’t an option. Transactions happen 24/7, across EMV contact, contactless, and magstripe interfaces. Yet many QA teams still rely on testing that happens late in the development cycle. Problems are often discovered weeks into regression campaigns, when fixing them is most costly and disruptive.

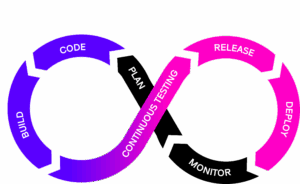

In the context of card present payment testing, Continuous Integration and Continuous Deployment (CI/CD) means that every change to software or firmware automatically triggers a set of tests on real hardware. Continuous Integration ensures that updates are verified immediately through regression and functional testing, while Continuous Deployment pushes those changes forward only when the results are successful.

Instead of running tests only after development is complete, CI/CD pipelines integrate automated payment testing into every step of the process. Each new software build or firmware update triggers regression tests for payments, ensuring that quality and compliance are verified continuously, not just at the end. This creates a constant feedback loop where issues are identified early, long before they reach certification or production.

By applying CI/CD principles, QA teams move beyond traditional automation. Testing becomes repeatable, scalable, and reliable, helping organizations shorten release cycles, strengthen compliance, and deliver with confidence.

How to Implement CI/CD in Payment QA

The first step in implementing CI/CD for payment QA is to redefine how tests are triggered. In a CI/CD model, every build or configuration update initiates automated test runs. These runs can include regression testing, functional testing, stress testing, and even EMV Level 3 pre-certification tests.

A proven best practice is to structure test cases into test sets and duplicate them for each new firmware version. This approach preserves backward compatibility and prevents confusion when comparing results across releases. Over time, this builds a clear version history that identifies precisely which release introduced a defect.

The infrastructure required to support this model is straightforward but essential. PaytestHub provides centralized test execution and enables automated regression runs to be triggered through the platform. This allows complete regression sets to run unattended overnight, with detailed results ready by the next morning.

The Impact of CI/CD on Payment QA

The most immediate benefit of CI/CD is speed. Regression test cycles that previously took weeks or weren’t performed due to time constraints can now be completed overnight, significantly reducing the time required for release schedules.

Equally important are accuracy and repeatability. Each test run is orchestrated in the same way, guaranteeing consistent outcomes. When failures occur, PaytestHub automatically captures proof. Screenshots from the terminal display, Android Debug Bridge (ADB) live streams, or payment interface logs from OPI, Nexo, GenPay, or other integrations provide detailed evidence of what went wrong. This level of traceability reduces the need for retesting and makes troubleshooting more efficient.

CI/CD also enables scalability. With cloud-based payment test management, distributed teams can access the same environment and execute tests on shared hardware, orchestrated centrally through PaytestHub. This ensures consistent results across regions and supports complex campaigns such as POS-ECR integration testing and EMV L3 certifications.

Finally, CI/CD improves agility. When new compliance requirements or firmware updates arise, test cases can be updated and executed automatically within the pipeline. This eliminates delays and ensures that quality and compliance are maintained continuously.

Best Practices and Lessons from the Field

Maintaining strict discipline in test case management is critical. Linking test sets to specific firmware versions ensures that results remain valid and comparable over time, while also supporting audit and compliance requirements.

Nightly regression runs are another best practice: thousands of transactions can be executed while teams are offline. Each morning begins with a full report of pass and fail results, with detailed evidence for every failed case. Whether it is the last message displayed on a terminal or the response from a payment interface, this data offers clear insight into the cause of a failure.