Retail checkout systems are expected to operate flawlessly, yet they are one of the most fragile environments to validate. A single transaction depends on synchronized behavior across barcode scanners, POS software, cash registers, payment terminals, printers, firmware versions, and multiple payment methods. When any link in this chain fails, the result is not a simple failure – it is unpredictable system behavior that is difficult to reproduce and even harder to diagnose.

Many teams believe they are performing comprehensive payment software QA when in reality they are testing fragments. Validating isolated components creates the illusion of coverage while leaving integration risks exposed. The challenge is not merely verifying whether a payment succeeds in isolation, but confirming that the entire checkout experience behaves consistently under real operating conditions. That distinction is what separates partial testing from true end-to-end automated testing.

Why Checkout Testing Breaks Down in Real Environments

Checkout testing becomes fragile because of the sheer number of moving parts involved in a single transaction. A real checkout flow requires prepared barcodes, correct payment cards, consistent sequencing, and disciplined execution. Every run must follow the same order of operations to remain consistent.

Manual testing introduces variability at every step. Testers must remain highly focused to avoid skipping actions, selecting the wrong cards, or executing steps in a different sequence. The more complex the test case becomes, the harder it is to maintain execution discipline. This is not a skill problem, but a structural limitation of manual workflows attempting to replicate highly repetitive, multi-step POS EMV test automation.

Hardware diversity compounds the difficulty. Different POS models, screen sizes, printer configurations, and terminal combinations create environment-specific behavior. When teams attempt to validate these components in a single flow with multiple payment methods, setup effort grows exponentially. As complexity increases, consistency decreases.

The result is fragmented validation where teams cannot guarantee that each run represents the same conditions. This is where terminal QA automation becomes essential to maintain a “gold standard” for every test run.

What Full Checkout Automation Actually Means

Full checkout automation is the replication of the complete customer journey, not just the payment event. A shopper enters a store, scans items, optionally applies discounts or vouchers, selects a payment method, completes the transaction, and receives a receipt. Each step influences the next.

Testing only the terminal ignores the upstream behavior that triggers the transaction. If POS firmware updates are not compatible with the terminal, or terminal firmware changes affect POS behavior, isolated testing will not expose the issue. Only continuous, end-to-end flows reveal compatibility risks between systems.

Full checkout automation ensures that every component, POS, peripherals, terminal, and software, is validated together as one system. This approach mirrors how checkout behaves in the real world. Partial validation cannot provide the same level of confidence.

It is important to distinguish between standalone terminal testing and POS-ECR integrated setups. Teams working with standalone payment terminals do not require POS-level automation. However, organizations operating fully integrated environments must validate the interaction between physical hardware and the POS system. PaytestECR exists specifically to automate those integrated scenarios.

Step-by-Step Automation of the Checkout Experience

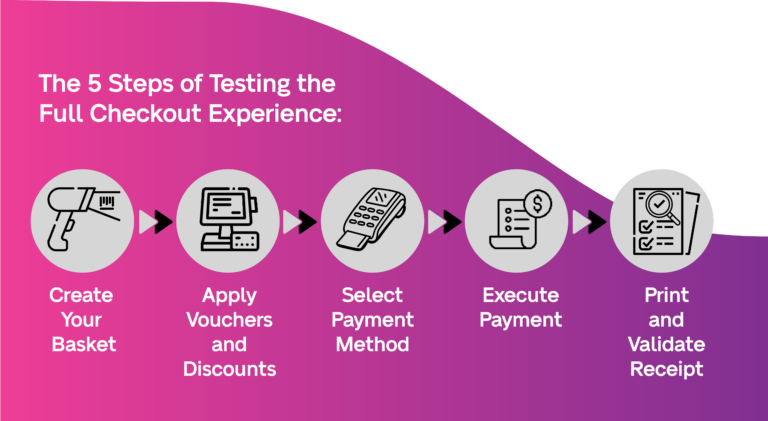

PaytestECR structures checkout testing into a repeatable five-step workflow that mirrors the real retail process using advanced payment testing solutions.

Step 1: Build the tender

The process begins with basket creation. Items are added through barcode scanning or POS interaction. This replicates real cashier behavior, including scanners embedded in belts or handheld devices. The system validates UI behavior and item handling exactly as it occurs in the store.

Step 2: Apply vouchers and discounts

Optional adjustments such as vouchers or discount codes are added. These scenarios are often skipped in manual testing due to complexity, yet they represent critical real-world behavior. EMV L3 test automation ensures these variations are always covered.

Step 3: Select the payment method

The POS triggers the tender choice, allowing cash, credit cards, vouchers, and alternative payment methods to be executed under identical conditions. This step validates how the POS routes the transaction while the payment terminal interaction is automated through PaytestLab hardware, ensuring contactless card testing, PIN entry, authorization timing, and terminal responses are validated exactly as they occur in live environments.

Step 4: Print and validate the receipt

The receipt is printed, scanned, and compared against expected output. PaytestHub confirms that the transaction evidence matches the expected result. This final step completes the payment QA orchestration by including the physical output, not just the approval status.

Step 5: Test case validation

Once the automated test case execution has been completed, it is being validated from PaytestHub against the expected parameters and confirmed as a pass or failure. During that step, all necessary log information, receipts, payloads or artifacts are being collected and stored for reporting. A centralized test execution report is being generated automatically for proof of work or to add to the release notes.

This structured flow transforms checkout into a repeatable sequence that can be executed as many times as needed to cover all use cases.

Why Repeatability Outweighs Speed

Speed without repeatability has no diagnostic value. A bug that cannot be reproduced cannot be proven.

Regression tests for payments allows teams to run identical transactions hundreds of times and detect patterns that would otherwise remain hidden. For example, if a transaction is expected to complete within five seconds and every tenth run exceeds that threshold, automated EMV testing surfaces a performance issue that manual testing would likely miss.

Repeatability ensures that when a defect appears, it can be triggered again under the same conditions. This converts anecdotal failures into measurable evidence. Reliable checkout testing depends on the ability to reproduce behavior consistently across a multi-terminal test tool setup.

Real-World Impact on QA Operations

The most immediate effect of PaytestECR adoption is the reduction of manual workload. Tasks that previously required constant tester supervision to become automated test case execution workflows. This frees teams to focus on expanding coverage rather than repeating execution.

With automation in place, organizations can dramatically increase the number of test cases they run. Instead of validating a handful of flows, teams can execute dozens or hundreds, covering additional payment cards, contactless interfaces, and edge cases that were previously impractical.

Regression testing improves in both depth and scale. Automated checkout flows integrate naturally into CI/CD pipelines, allowing organizations to validate continuously instead of periodically. The testing experience shifts from reactive to proactive.

This scalability changes the economics of QA. Testing expands from sampling to portfolio-level validation.

The Future of Checkout Testing

Checkout testing is moving toward full-system automation. Historically, teams lacked a practical method to validate every layer of the retail stack simultaneously. Manual processes forced organizations to accept partial coverage.

End-to-end automation removes that limitation. Hardware-agnostic validation allows teams to test across devices, manufacturers, and environments without being locked into specific setups. This flexibility enables true scalability.

The industry is transitioning from manually testing a few scenarios to validating entire retail ecosystems. That shift represents a fundamental change in how checkout reliability is achieved.

Checkout is not a single event, but a chain of dependent behaviors that must operate in harmony. Testing fragments of that chain provides incomplete assurance.

PaytestECR turns the full checkout journey into a structured, repeatable workflow. From the first barcode scan to the final receipt validation, every step becomes measurable and scalable.

Ready to see how full checkout automation works in your environment? Book a meeting with our team to explore how PaytestECR can replicate your real checkout flows, expand your coverage, and bring repeatable end-to-end validation into your QA process.