Modern payment testing requires far more than a stack of test cards and a few manual swipes. QA teams need to validate transactions across EMV contact, contactless, and magnetic stripe transactions, all while ensuring accuracy, repeatability, and compliance with industry standards. Without the right tools, this quickly becomes slow, error-prone, and difficult to scale.

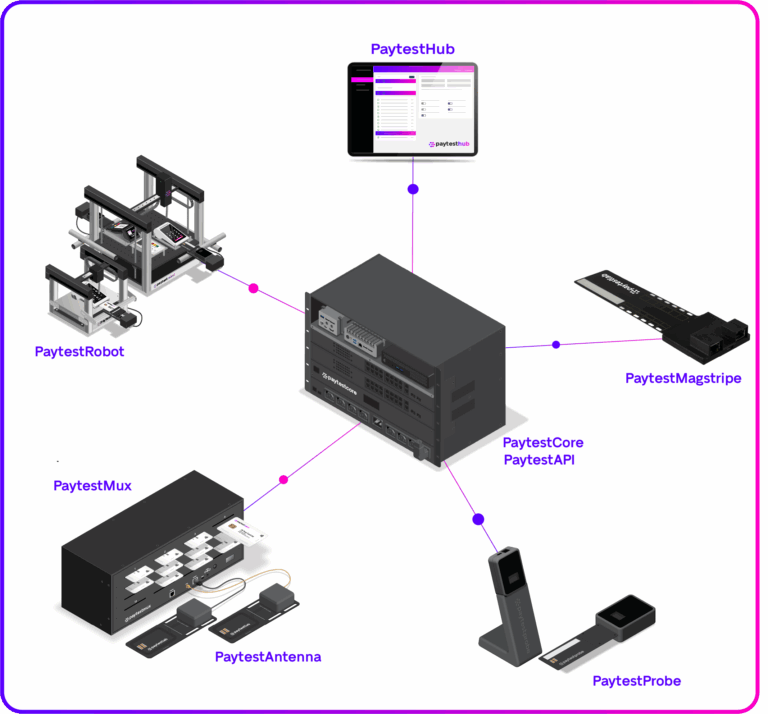

To address these challenges, PaytestLab offers its PaytestProbe and PaytestMux, designed to simplify testing across chip, contactless, and magnetic stripe interfaces. Together, they deliver a complete card payment testing setup that’s automated, efficient, and easy to manage. This integration allows testers to cover all card interfaces, scale across multiple devices, and ensure compliance while reducing manual effort. In this blog, we’ll explore the PaytestProbe, PaytestMagstripe, and PaytestAntenna, showing how they interact with the PaytestMux and provide guidance on best practices for building a future-proof automated testing setup.

Understanding PaytestProbe, PaytestMagstripe, and PaytestAntenna

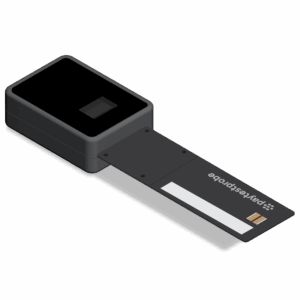

PaytestProbe

The PaytestProbe combines chip contact, contactless, and magnetic stripe interfaces in a single probe. This simplifies setup, accelerates execution, and ensures consistent, repeatable results. Its versatility reduces manual effort, lowers infrastructure complexity and costs, and makes scaling test environments easier. With PaytestProbe, QA teams can focus on improving quality instead of managing hardware or physical cards.

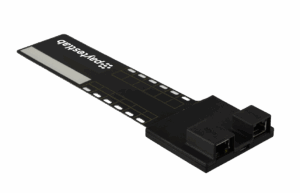

PaytestMagstripe

he PaytestMagstripe probe is installed in the magnetic stripe reader and sends an electronic signal, eliminating the need for physical swipe actions. This emulation ensures consistent, repeatable results — critical for regression tests for payments and terminal QA automation. It supports Track 1, Track 2, and Track 3 data, which can be dynamically configured at any time within PaytestHub or through the PaytestAPI.

PaytestAntenna

The PaytestAntenna provides both contact and contactless capability in a single piece of hardware. It comes standard with the PaytestMux, though it is not supported in the network-enabled configuration. For chip transactions, it can be mounted on the PaytestRobot T1/T4 arm to perform insertions into the terminal. For contactless tests, it is positioned near the contactless reader to simulate tap transactions. This combined functionality makes it an ideal starting point for automated EMV testing, ensuring QA teams can validate contact and contactless interfaces with accuracy and repeatability.

Unlocking scalability with the PaytestMux

Out of the box, the PaytestMux comes with two PaytestAntennas — one for contact and one for contactless. In this standard mode, testers can insert EMV test cards into the 16 slots of the PaytestMux, and each slot can be activated one at a time from either interface during a test case. Only one card is active during a test, ensuring accuracy in test execution and preventing conflicts and collisions. This setup eliminates a large portion of manual card handling, delivering greater consistency and reducing the potential risk for human error.

Beyond the default configuration, the PaytestMux can be upgraded with a firmware option to enable network mode. In this mode, the PaytestMux connects to TCP/IP networks and allows multiple PaytestProbes to be used across the same environment. The PaytestProbe supports EMV contact, contactless, and magnetic stripe interfaces, making it the essential probe for full coverage in an automated and network-enabled setup. In network mode with the PaytestMux, the PaytestProbe becomes mandatory, while PaytestAntennas are no longer supported.

Network-enabled mode provides reliability and accuracy when scaling test environments, enabling distributed collaboration. With one PaytestMux connected to multiple PaytestProbes, teams can distribute card access across several terminals and even multiple PaytestRobots. For example, a single PaytestMux can support eight PaytestProbes shared across a PaytestRobot T4 to test four terminals simultaneously over the local network. Teams can then run regression tests, certification campaigns, and stress testing on the same physical cards and terminals, orchestrated centrally through PaytestHub. For this to work, the PaytestMux must be connected to the same network as PaytestHub, ensuring stable communication and control. Because the PaytestProbe covers all three key interfaces, it ensures that online, offline, and fallback scenarios are included in the test plan.

Choosing the right setup

Choosing the right probe setup depends on your testing environment and goals. The PaytestAntenna is best suited for standard setups with the PaytestMux, where simplicity and ease of use are priorities. The PaytestMagstripe is ideal for consistent swipe emulation and for working with dynamic Track 1, Track 2, and Track 3 data. The PaytestProbe is the most versatile option, supporting full automation, network-enabled testing, and L3 test tools from Fime and ICC Solutions, all while integrating seamlessly with PaytestHub. For distributed teams or growing environments, upgrading the PaytestMux firmware unlocks network functionality, allowing multiple PaytestProbes and PaytestRobots to operate in parallel. To ensure accuracy and consistency, developers should always reference the official PaytestAPI and helpdesk resources for the latest specifications.

Strategic perspective for building a resilient testing ecosystem

PaytestLab’s probes and PaytestMux are designed to work together as part of a unified payment testing platform. By combining the PaytestProbe, PaytestMagstripe, and PaytestAntenna with the PaytestMux, QA teams can cover all critical interfaces while managing cards intelligently. When integrated with PaytestHub, this setup evolves from simple hardware management into a streamlined payment QA orchestration environment that ensures accuracy, repeatability, and efficiency.

Whether you’re preparing for functionality testing, EMV L3 certification, POS-ECR integration testing, or managing complex regression cycles, this ecosystem future-proofs your testing infrastructure. It allows QA teams to test faster, smarter, and at scale, making payment testing not just manageable but a true enabler of innovation. The result is a streamlined approach to payment QA that enables businesses to move faster while remaining compliant and secure.