Aera

Aera is a payment terminal manufacturer developing its terminal software fully in house. Operating in fast moving payment environments, Aera releases new software

Revel Systems is a dynamic company with a workforce of nearly 600 dedicated employees. Their engineering operations span across multiple locations, including Lithuania and the United States. Revel’s offices are a powerhouse of talent, with many professionals providing 24/7 support services, ensuring unwavering assistance to their valued customers.

As a leading provider of a cloud point of sale (POS) platform, Revel Systems has many distinguishing factors, including an extensive network of integrations with various payment gateway providers. Unlike some competitors, Revel Systems doesn’t rely on in-house payment processing; instead, they collaborate with a diverse array of providers to cater to different countries and integration needs. This approach results in a highly versatile POS platform that seamlessly connects with numerous terminals and integrates with various payment processing solutions, making it an ideal choice for businesses seeking a wide range of payment options and integrations.

Revel Systems stands out for its customer-centric approach. Their platform is meticulously designed with the end-user in mind, offering unparalleled ease and comfort. By harnessing the power of iOS tablets, they provide a user-friendly interface that ensures a familiar transaction experience. With remarkable versatility and a cloud infrastructure, Revel Systems empowers businesses to manage their operations in real-time, making it a game-changer in the POS industry.

One challenge Revel faced before partnering with PaytestLab centred around their efforts to automate certain processes, specifically in the context of payment terminal testing. The main obstacle they encountered was their inability to fully control the payment terminal during chipbased transactions. Unlike contactless transactions, where you can simply place a card on the terminal and automate the testing to some extent, chip transactions require physical interaction with the card, which made complete automation impossible.

“The main problem was our ability to control the payment terminal… the only thing we could test automatically was contactless transactions by leaving a card on the terminal. However, that doesn’t mimic real time usage and didn’t help cut down testing time, all while limiting us to simulate very few cases.” – says Eitvydas Korsakas, Senior Quality Manager, Payments and Devices

This limitation resulted in a significant efficiency roadblock for the company because they couldn’t test chip transactions in an automated manner. While they could automate some aspects of testing for contactless transactions, these didn’t accurately replicate real-world usage scenarios, and they didn’t contribute to a substantial reduction in testing time. Essentially, their existing methods only covered a limited set of testing scenarios.

In their quest to address this challenge, the company explored the possibility of mocking responses from the payment terminal. However, this approach still fell short of providing the comprehensive end-to-end testing capabilities they required. In essence, they needed a solution that would allow them to automate the testing of chip transactions fully and realistically without the need for constant physical card manipulation. This was the central problem that PaytestLab aimed to solve for them.

Revel’s decision to collaborate with PaytestLab emerged from a process of exploration and a keen interest in automating certain aspects of their operations. The journey began when they started contemplating the potential benefits of automation. During these discussions with members of the team, one consideration included a company called PaytestLab, which specialized in automation solutions. Intrigued by the possibilities, they decided to delve deeper into what PaytestLab had to offer and assess its capabilities first hand.

In the Revel team’s quest to identify potential competitors or alternatives, they conducted technical research, but findings in the public domain were rather limited. Despite attending various testing conferences, there appeared to be a scarcity of comparable offerings. An exact fit for the Revel team’s needs remained elusive.

PaytestLab’s unique capabilities and suitability for their requirements ultimately led them to give their automation solution a try. The PaytestLab offerings stood out in a landscape with limited publicly available alternatives and promised a fit with their automation needs.

In their iOS testing setup, Revel Systems employs the Ranorex testing framework, which adds a layer of complexity due to the intricacies of iOS testing. Ranorex is a versatile, multi-platform testing tool capable of conducting tests across a spectrum of platforms, including web-based applications, Android apps, and iOS apps. To enable iOS testing with Ranorex, a crucial step involves instrumenting the applications in a specialized manner. This instrumentation allows the Ranorex server to execute actions based on explicit elements within the iOS environment, facilitating automation. Additionally, Revel has developed a custom C# plugin within Ranorex to establish seamless communication with PaytestLab, leveraging API integration rather than relying on the front-end interface. This integration involves the use of API calls to transmit commands at specified intervals, enhancing the efficiency and precision of their testing processes.

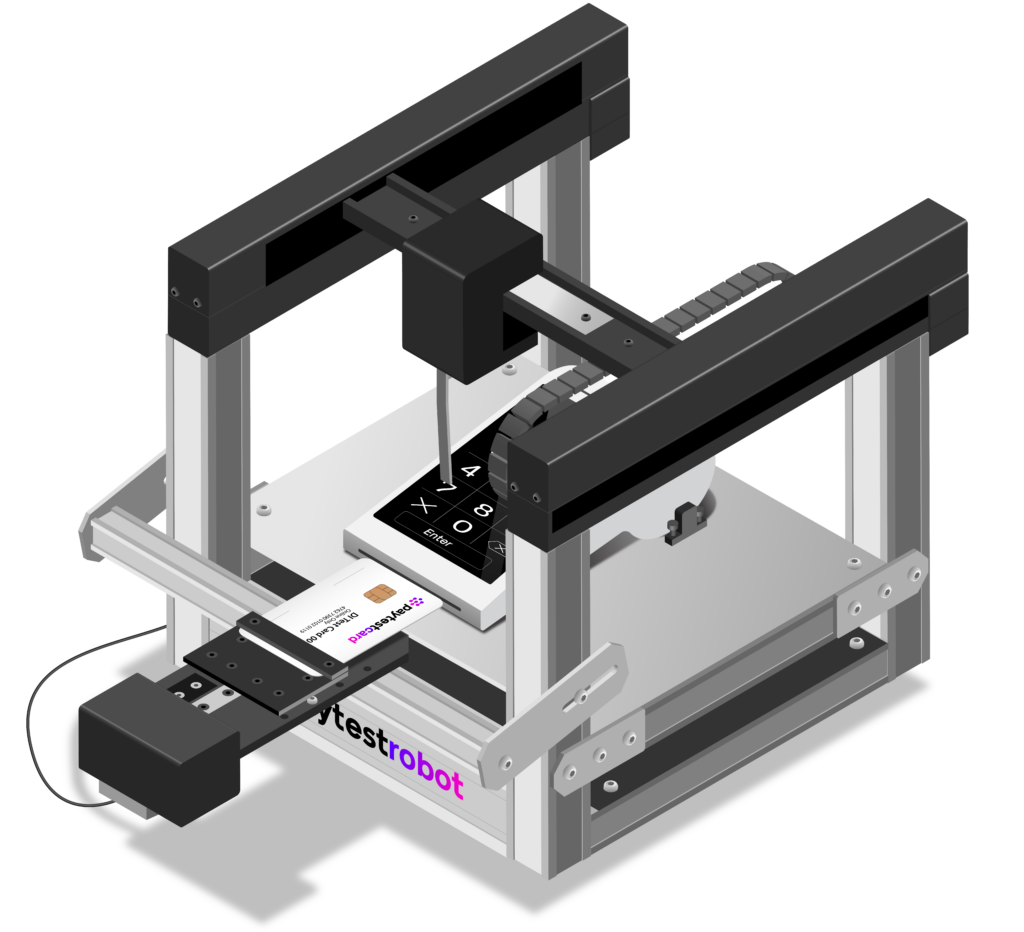

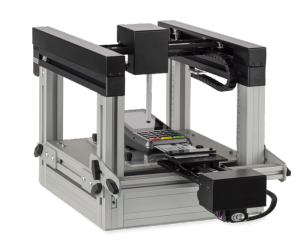

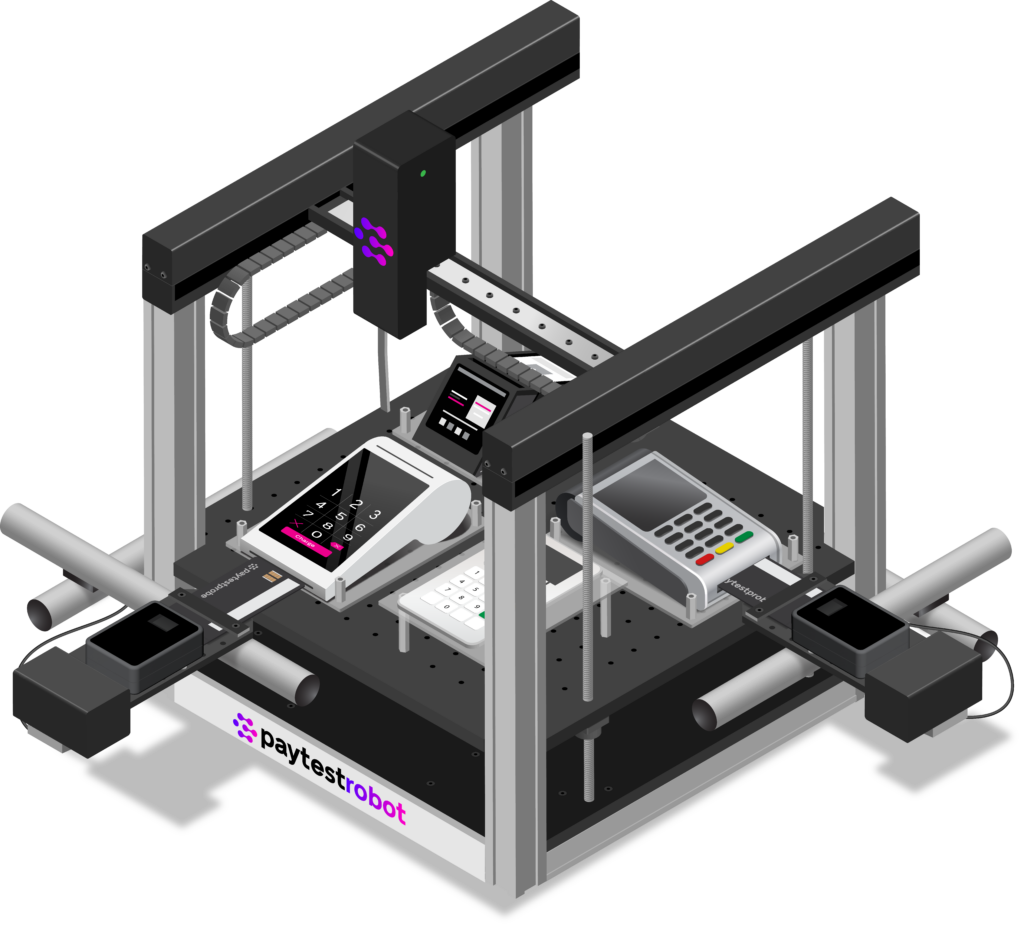

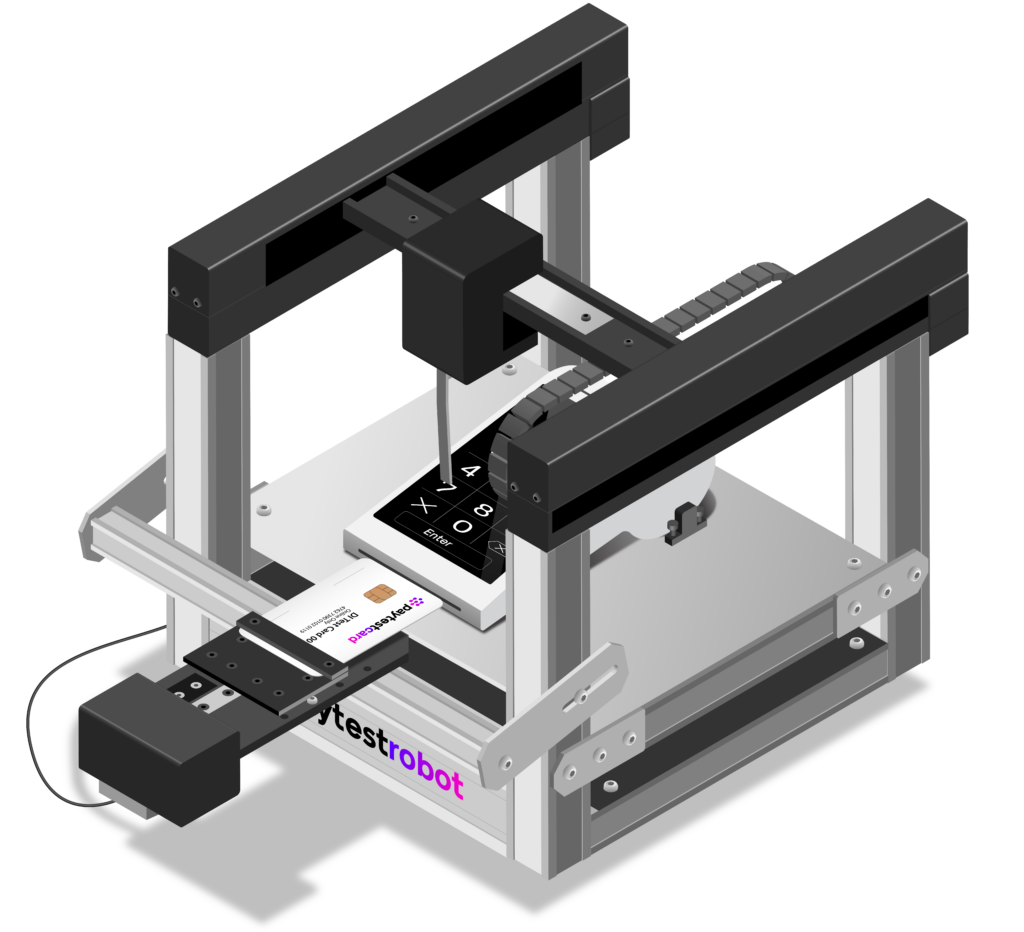

Revel now utilizes two Robot T1 in combination with a contact and contactless multiplexer and a magstripe probe from PaytestLab.

Introducing PaytestLab automation solutions has proven to be a pivotal solution to their challenges, though they’re still in the process of gathering concrete statistics. Initially, Revel’s team faced limitations in their testing, particularly in scenarios involving payment processing. For instance, during card entry, there’s a critical moment when the PIN must be entered, but some integrations don’t return this PIN entry state explicitly. This led to uncertainties regarding the timing of PIN entry.

To provide context, they have three integrations under scrutiny, with one of them involving four different devices. Two of these devices offer two distinct connection types (Wi-Fi and Bluetooth), amounting to eight devices for a single regression test. Previously, Revel’s employees conducted this comprehensive testing manually, a painstaking process requiring the attention of three quality assurance manual engineers over two weeks.

With the introduction of their first robot, they managed to reduce the testing timeline to just four days, shaving off a whole week of valuable testing time. The team is optimistic that the addition of a second robot will further reduce testing time to 1.5 days. This efficiency has the potential to accelerate their software release cycles and allow them to perform more rigorous testing, uncovering additional bugs in the process.

“Previously, we would have a big software release and we would regress everything in two weeks. Now, we can do it in four days. It is a huge improvement. One thing it allows is to test harder, because we have robots running and discovering all of the usual test cases. We can explore more in the software and find even more bugs. So, it has been a good thing to have!” says Eitvydas Korsakas, Senior Quality Manager, Payments and Devices

The automation provided by PaytestLab doesn’t replace Revel’s talented testers but rather complements their efforts. None of their three dedicated employees were made redundant. Instead, the PaytestLab addition has enabled them to release software more frequently. In the past, they released software every 2-3 months, but now they can push out releases more rapidly, addressing software imperfections and enhancements as needed. With automation in place, they can swiftly transition from development to automated testing, obtaining results within three days. This agile approach has proven invaluable, as it allows them to promptly identify and communicate critical issues to their vendors, facilitating quicker fixes and more robust software development.

Revel runs their robot overnight for stress testing. While they don’t necessarily have enough test cases to occupy the robot for a full 24 hours, they often set them to repeat multiple times. For example, in one instance, they launched 150 test cases and repeated them 2-3 times to ensure stability. As they progress, they may explore full-day testing. They’ve seen impressive stress testing records in some of the PaytestLab demonstrations and articles, with some running as many as 5,000 tests.

Revel acknowledges that the PaytestLab advantage lies in our versatility – we can conduct tests on virtually any terminal, free from manufacturer constraints. This means that if you decide to switch terminals, there are no limitations on the devices we can support.

That’s a noteworthy advantage; you have the flexibility to create the necessary baseplates and aren’t bound by specific devices.

Aera is a payment terminal manufacturer developing its terminal software fully in house. Operating in fast moving payment environments, Aera releases new software

Faced with increasing regression demands and the limitations of manual card testing, KWI turned to PaytestLab’s PaytestRobot to automate real-world payment transactions across

Worldline is a leading global provider of payment and transactional services, operating in the fintech and digital payments sector. Known for offering innovative

Abrantix is a Swiss software innovator in payment solutions, delivering advanced EFTPOS terminal software for secure, efficient global transactions. Known for quality and

KoCo Connector GmbH leads the way in pioneering IT solutions that transform healthcare, elevating both well-being and quality of life.

Ingenico Switzerland, a vital subsidiary of the global Ingenico Group, pioneers secure and innovative electronic payment solutions, offering tailored services and cutting-edge payment

Nexi Switzerland, an integral part of the European PayTech Nexi Group, is composed of a team of approximately 100+ dedicated individuals committed to