Aera

Aera is a payment terminal manufacturer developing its terminal software fully in house. Operating in fast moving payment environments, Aera releases new software

Worldline operates on a global scale, with a presence in over 50 countries and a workforce exceeding 18,000 employees worldwide. It has a significant market share in the payment sector, serving a wide range of businesses, from small and medium-sized enterprises to large corporations. The company’s extensive reach and technological expertise make it a trusted partner for secure, efficient, and scalable payment solutions tailored to diverse client needs.

Worldline faced a critical challenge in their quality assurance (QA) processes. Their manual testing procedures for Android-based payment terminals like the Castle S1F2 and Ingenico DX 8000 were no longer sustainable. The rapid expansion of payment application features, the increasing complexity of devices, and the need for frequent updates created significant inefficiencies.

Despite implementing various frameworks and strategies, Worldline frequently encountered delays and inefficiencies when conducting comprehensive regression testing or managing multiple device configurations. The extensive manual effort required to execute over 500 test cases across four to five different payment device models placed a significant strain on resources, with each device requiring 1.5 to 2 days of testing. As a result, full regression testing for a single application release stretched seven to ten days, creating major bottlenecks that hindered Worldline’s ability to meet project deadlines efficiently. As the complexity of their testing environment grew – driven by the need to support multiple payment terminals with individualized testing requirements – their workload intensified. This escalating complexity clashed with the need for more extensive test coverage without further extending already lengthy testing cycles. Worldline’s existing tools couldn’t keep pace with the growing demand for flexibility, rapid deployment, and scalability. Testing across a diverse array of devices became increasingly unsustainable, especially as new features were rolled out rapidly to stay competitive in the payments industry. Worldline urgently needed a solution that could seamlessly integrate into their operations, enhance efficiency, and accelerate testing processes without compromising reliability or quality.

With tight release cycles and pressure to maintain high quality, Worldline needed a robust automation solution that could seamlessly integrate with their existing framework while accelerating their testing efficiency.

“The time was one of our biggest pain points. By the time we introduced automation itself, we were already quite far along, so scalability and managing the workload were significant challenges.” – Aravind Krishna Kumar, Testing Engineer at Worldline.

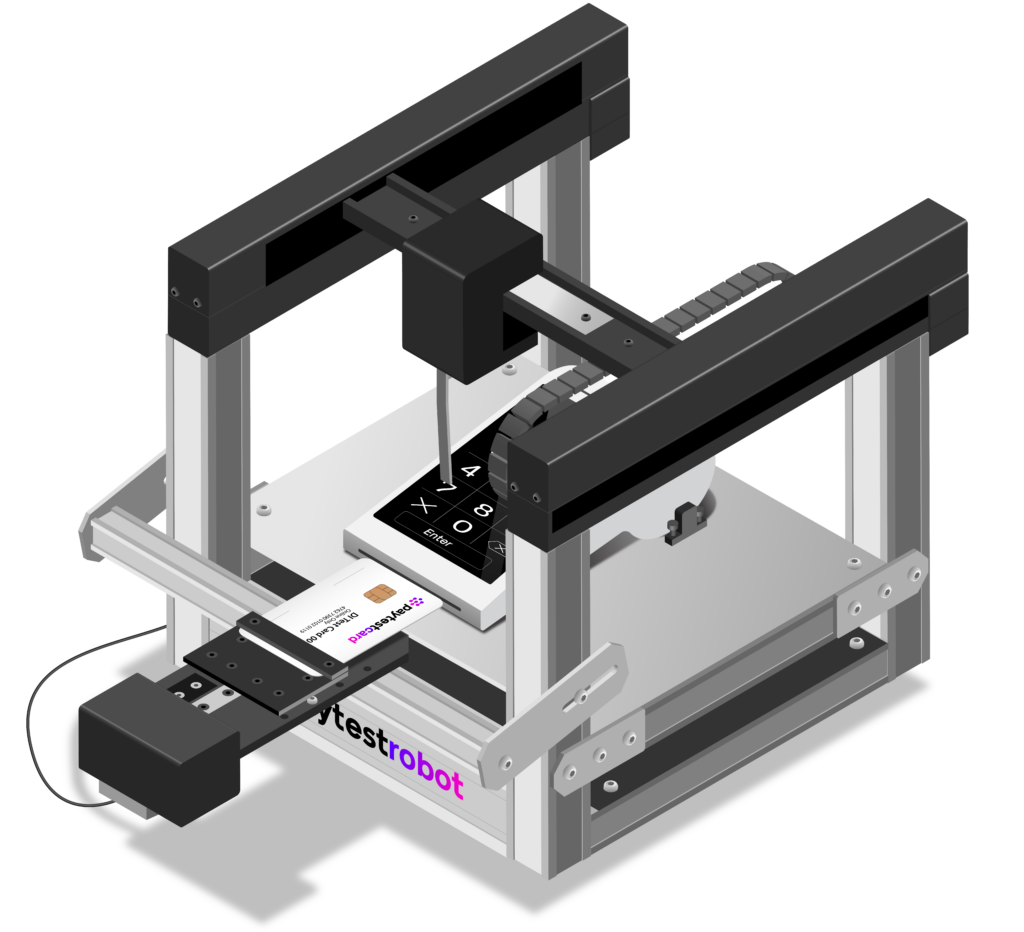

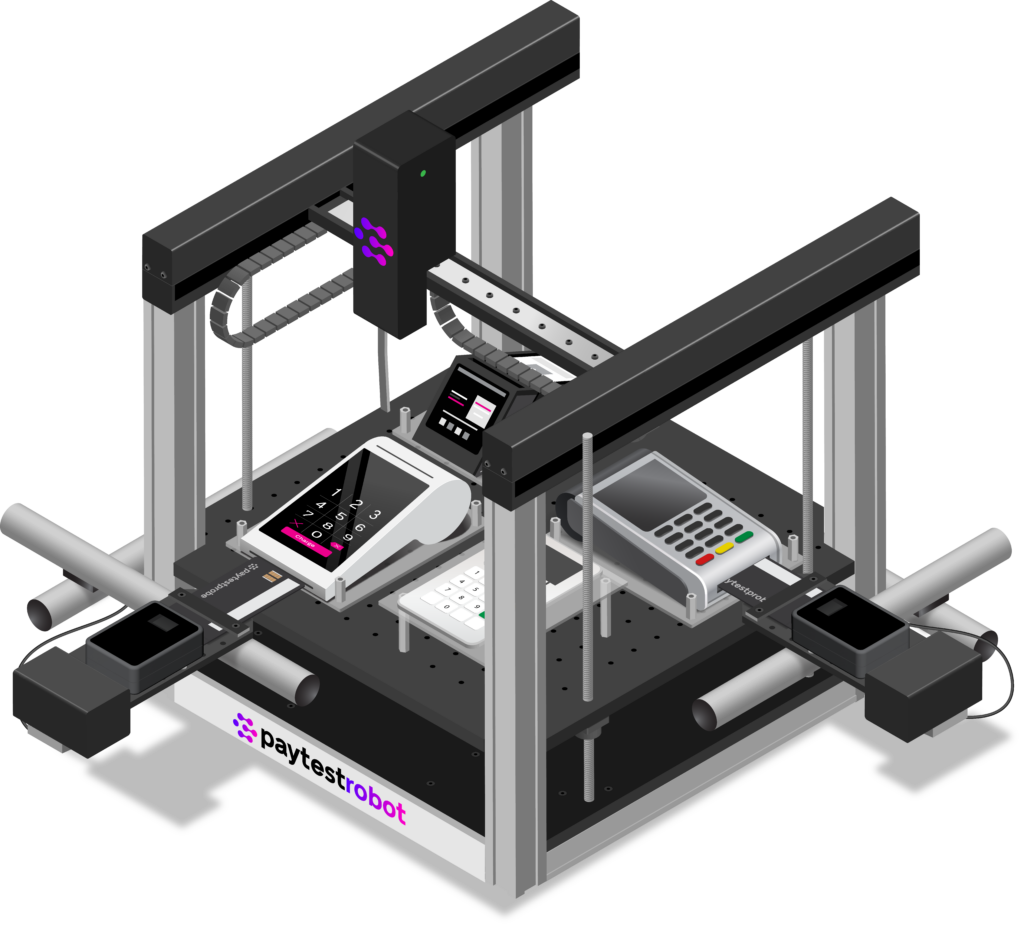

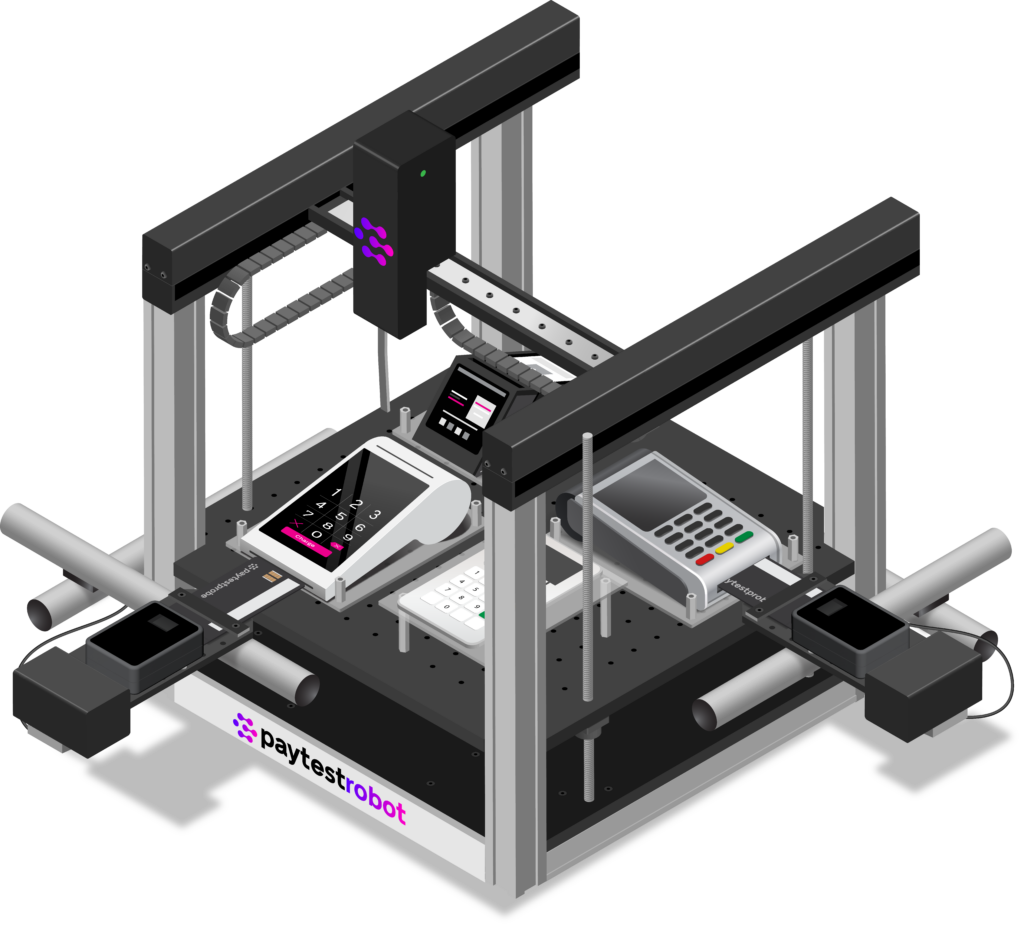

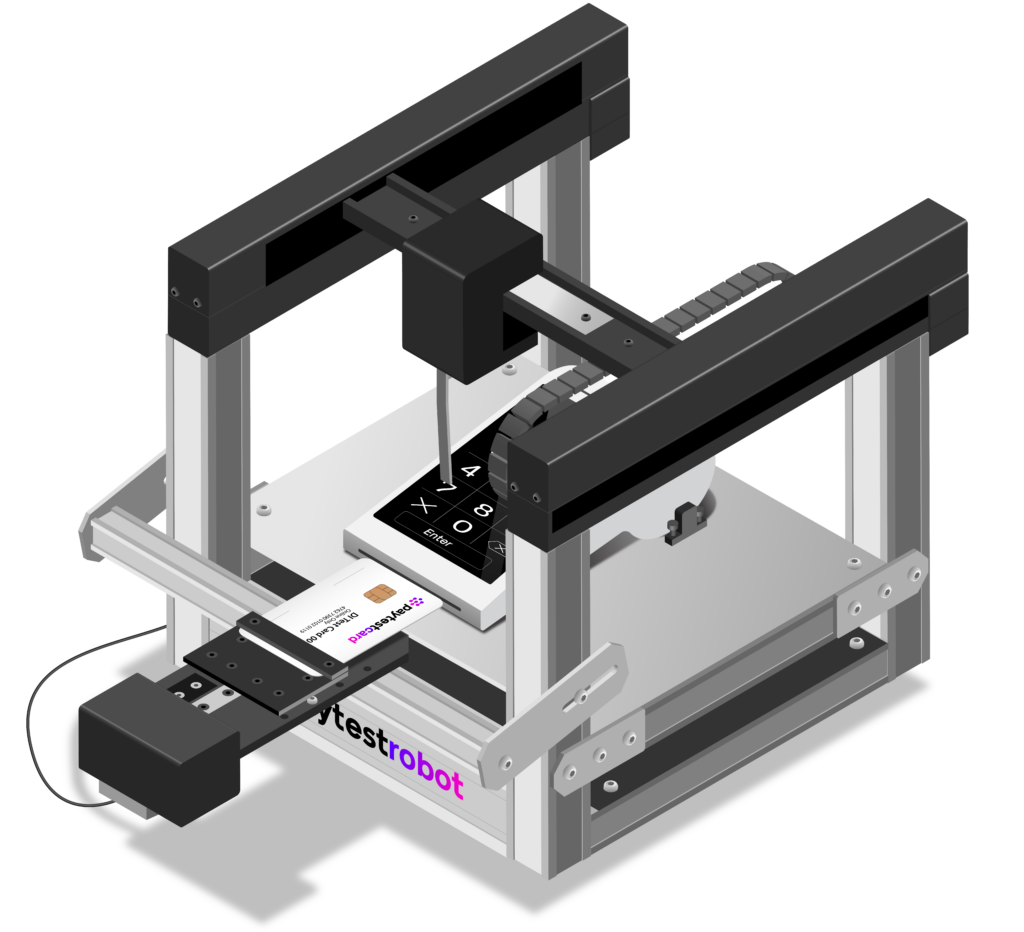

PaytestLab emerged as the ideal partner, offering a suite of automation solutions tailored to Worldline’s needs. The deployment included:

With the initial deployment of automation, test execution time per device was dramatically reduced from two days to just four to six hours, enabling rapid test cycles and faster time-to-market. This automated framework significantly improved scalability, allowing Worldline to increase their test case execution from 500 to 2,500 per week, ensuring broader coverage and higher reliability.

The implementation of PaytestLab’s automated testing solutions marked a turning point for Worldline, enabling them to fully automate testing across multiple devices, including unattended terminals and mobile payment applications. This transition immediately delivered a 50% reduction in intial test exection time, cutting testing from two days to just one. With the full deployment of PaytestRobot and PaytestMUX, execution time was further reduced from two days to just four to six hours, significantly accelerating release cycles while maintaining high reliability.

By adopting advanced automation features like multi-device testing and centralized orchestration, Worldline successfully streamlined their testing workflows, allowing them to increase their weekly test case execution from 500 to 2,500, ensuring broader test coverage and enhanced software quality while keeping pace with tight release schedules.

One of the key factors in Worldline’s successful automation journey was the ease of integration. While initial onboarding presented the usual challenges, PaytestAPI proved to be straightforward to implement, backed by comprehensive documentation and responsive technical support. This seamless adoption allowed Worldline’s QA team to rapidly integrate automated testing into their existing framework without disrupting ongoing development efforts.

Additionally, features such as multi-card reading with PaytestMUX and advanced regression testing further enhanced efficiency and accuracy, enabling Worldline to address immediate pain points while scaling their automation efforts as testing requirements expanded. Beyond reducing manual workload, automation freed Worldline’s QA engineers to focus on higher-value testing activities, such as strategic test design and exploratory testing. By eliminating bottlenecks and ensuring more reliable, consistent, and scalable test execution, Worldline optimized resource utilization, allowing them to meet the demands of a fast-paced payments industry with greater agility and confidence.

Reflecting on the transformation, Aravind Krishna Kumar, Testing Engineer at Worldline, shared: “It made our QA jobs much easier. To be honest, that’s the best thing that can be done – it’s all about making our jobs easier.”

Aera is a payment terminal manufacturer developing its terminal software fully in house. Operating in fast moving payment environments, Aera releases new software

Faced with increasing regression demands and the limitations of manual card testing, KWI turned to PaytestLab’s PaytestRobot to automate real-world payment transactions across

Abrantix is a Swiss software innovator in payment solutions, delivering advanced EFTPOS terminal software for secure, efficient global transactions. Known for quality and

KoCo Connector GmbH leads the way in pioneering IT solutions that transform healthcare, elevating both well-being and quality of life.

Ingenico Switzerland, a vital subsidiary of the global Ingenico Group, pioneers secure and innovative electronic payment solutions, offering tailored services and cutting-edge payment

Nexi Switzerland, an integral part of the European PayTech Nexi Group, is composed of a team of approximately 100+ dedicated individuals committed to

Revel Systems, with nearly 600 employees in multiple locations, offers a leading cloud POS platform. Unlike competitors, they collaborate with various payment providers,